I have some good friends that operate an efficient, diversified, and functioning family farm in Northern Montana. They do all their activities on about 6 acres of land. We’re talking cows, pigs, laying hens, broiler chickens, ducks, dogs, cats, an acre worth of garden etc. Since we are still urbanites for the time being we like to get our eggs and dairy needs from them. On one of our previous visits I asked the farmer (I definitely consider them farmers) about their adjacent land. He responded "I’d love to buy it but they are asking a lot for it". I’m sure if they had the money they would expand in a heart beat but here lies the conundrum in being a farmer. Unless you:

- Have parents that are rich

- Inherited land

- Are willing to mortgage the farm

- Sell body parts other than the animals you are raising

- Spent many years saving

- Have a job other than being a farmer

- Or are big enough economies of scale come into play

It’s really hard to make the land pay for itself. Let’s do some simple math. Say you were able to come up with $100,000 to buy a piece of land. I don’t care how many acres that buys for the time being. How much money would you have to earn to make that investment worth it? Assuming you wanted to be paid back your money in 10 years you would have to net $10,000 a year after tax and expenses. This doesn’t even take into consideration the time value of money. Skip the next part if you are not an engineer, math wiz, or numbers person. ******************** For you finance majors, assume you want to keep up with inflation at 3%. You want to be paid back in 10 years and have invested $100,000. You would need to net $11,723 in cash per year for the next 10 years. Not to hard right? Well assume you only get to keep 50 cents of all you earn as the other 50 cents goes to expense (interest payments, taxes, gas, utilities, irrigation, feed, labor, etc.) Your gross revenue would have to be just under $24,000. That is probably doable. Yippee, you get to keep up with inflation. You might as well put your money in a GIC or money market account. (I really got depressed after crunching more numbers. For example, say you wanted an 8% return and only got to keep 30 cents of every dollar. You would then have to gross nearly $50,000 a year to have a positive net present value on $100,000 worth of land.) ******************* So can you net after all costs and taxes $10,000 a year on $100,000 of land? I’ll leave that as an open ended question. Here is what we’ve done in the last two years on our farm. We have net roughly $3,500 per $100,000 worth of land not including mortgage. I actually think that is quite good as all we did was sell 40 acres of alfalfa on the stump and rent out pasture land for 40 head of cattle. So a couple of recommendations to try to get the most out of your land:

- Consider investing as little as you can – ($100,000 is a lot of money, you wouldn’t need that much of a return on $20,000 worth of land). My wife said it best with “Don’t buy the garden of Eden, build it.”

- Specialize your outputs – Alfalfa isn’t going to make enough in proportion to the cost of a small piece of land

- Don’t invest in big or costly equipment – The smaller the investment the easier it is to have a reasonable payback

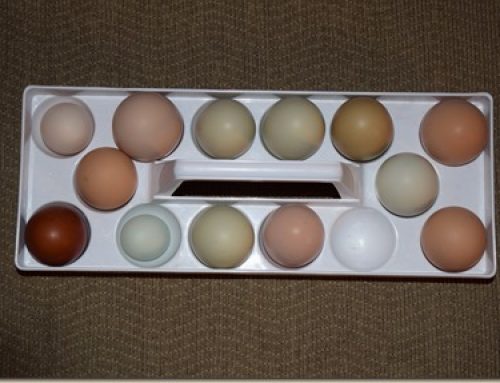

So how in the world are we going to go from basically loosing money to actually getting a return? I am convinced it will need to come from specialty products such as free range eggs, hormone free super duper good beef, honey, jam, organic vegetables, and maybe a few body parts.

2 Comments

Comments are closed.

My husband and I are considering buying a piece of property. Your post was well thought out and extremely entertaining. Thanks for this! -Sarah

Thanks Sarah. Hope you the best.